Content

If refund or credit is allowed more than 3 years from the date the return was filed, the amount allowable is the tax paid within 2 years preceding the date the credit or refund is allowed. Advance payment is considered made on due date. IRC 6513.After the due dateIt is within 3 years from filing of returnTax paid during the period immediately preceding filing of claim equal 3 years plus any extensions of time for filing can be refunded. IRC 6511 .After the due dateIt is more than 3 years from filing of the original returnTax paid during the 2 years immediately preceding filing of claim can be refunded.

Shall replace, repair, or correct supplies not received at destination, damaged in transit, or not conforming to purchase agreements. Agencies shall provide adequate safeguards regarding the control of forms and accounting for purchases. A paper purchase document may be issued if necessary to ensure that the supplier and the purchaser agree concerning the transaction. Individuals authorized to purchase under the BPA. If the contractor accepts the cancellation and does not claim that costs were incurred as a result of beginning performance under the purchase order, no further action is required (i.e., the purchase order shall be considered canceled).

Payments Mapping of ISO 20022 Direct Debit Message Structure for SEPA and CGI

Replies should include the employee control number and an explanation that if the taxpayer needs to contact the IRS, to return a copy of the letter, with his/her telephone number and best time to call, as indicated in below. For example, in Wachtel v. HealthNet, the Third Circuit declined to extend the fiduciary exception to insurers designated as fiduciaries under ERISA for two reasons. 482 F.3d 225 (3rd Cir. 2007). First, the court held that the need for the attorney-client privilege is at its highest when the law the client is seeking to comply with is complex, and the penalty is for non-compliance is great. Id. “An entity’s ability to secure confidential legal advice should not be at its lowest when complex legal obligations are at its highest.” Id. Critically, the court cited the fact that the insurer and the beneficiary have divergent and conflicting interests because they have different financial incentives; the “true client” could not be the beneficiary because their interests did not align with the insurer’s.

- An employer may switch the marginal functions of two employees in order to restructure a job as a reasonable accommodation.

- Even assuming that a specific intent to harm exception exists, such an intent cannot be established by the harm normally occasioned by the act of discharging an employee.

- IRS will not initiate assessments/offsets with the exception of child support during the period a taxpayer is in a combat zone, and for at least 180 calendar days thereafter.

- Close the IDRS control base to reflect the PMA is allowed.

- Instead, you need to make an assessment of tax that is based on the ELF filed or paper filed rejected return or payment posted on the account, whichever is greater.

This document addresses the rights and responsibilities of employers and individuals with disabilities regarding reasonable accommodation and undue hardship under Title I of the ADA. The respondent has a written policy explaining how an employee should request accommodation for a disability. (Test. Roy, 164; Ex. R-9) This policy was disseminated by mail in May of each year, including 1997, to all DRS employees and posted permanently on bulletin boards located on each memo created by exception supp floor of the DRS building. (Test. Alling, , 206) According to the policy, an employee must initially make a written request to the respondent’s Affirmative Action Administrator or to Alling, and must support the request with, among other things, medical documentation. Pen and ink changes may be made to appropriate blocks of the online Form 3999 or Form 3999-T, in order to ensure that the forms conform to our current organizational structure and position titles.

Office of Information Practices

Allow taxpayer correspondence received after the RSED that corrects a math error notice to adjust a previous math error provided that no formal notice of claim disallowance was previously issued by either certified/registered mail. If a notice of claim disallowance was previously issued, follow normal claim disallowance procedures. In Collection Due Process cases under IRC 6320 or 6330 in which Appeals considers the underlying tax liability, Appeals may determine that the taxpayer made an overpayment. If Appeals asks the Statute team to approve a credit or refund, the procedures stated in paragraph above, will apply.

Some jurisdictions analyze “direct threat” solely as an affirmative defense. P. 26; see, e.g., Maine v. Norton, 208 F. Following the 1990 census, the factual/deliberative distinction led to sharply contrasting decisions by two circuit courts of appeal, where the issue was the Commerce Department’s withholding of numeric material. Both the Assembly of the State of California and the Florida House of Representatives sought “adjusted” census figures for their respective states that were developed in the event that the Secretary of Commerce decided to adjust the 1990 census, a choice he opted against. The Court of Appeals for the Eleventh Circuit applied a rigid “fact or opinion” test in determining whether such numerical data are protectible.

Original Delinquent Returns

Payments are usually money amounts submitted by the taxpayer to satisfy tax liabilities on an original return or an amended return. A return/claim must be filed to claim the overpayment before the RSED. The taxpayer must sign the return under penalties of perjury. If a return is received unsigned, the Statute of Limitations on Assessment does not start until a signed return is received. Statute management will review 100% of manual refunds prepared by statute employees. Do not make an address change if TC 740 (S- Freeze) is on the tax module.

- If the ASED has expired, assign the case to RIVO as stated in paragraph .

- Formaldehyde, 889 F.2d at 1122 (quoting CNA Fin. Corp. v. Donovan, 830 F.2d 1132, 1161 (D.C. Cir. 1987)); see also Judicial Watch, Inc. v. Reno, 154 F.

- The RRB has established a ≡ ≡ ≡ tolerance.

- Additionally, there is no evidence even to suggest, much less demonstrate, that the complainant ever failed to keep files secure or confidential.

- B. If the Form 5329 is not attached, the period of limitations on assessment for the tax imposed by IRC 72 and begins with the filing of the Form 1040.

This means that if less than 90 days remain on the limitations period after the suspension ends, the difference between the number of remaining days and 90 days will be added to the limitations period. There is no automatic 90-day addition to the period. Statute employees must review all transcripts within 10 workdays. Returns/documents should be requested on an as needed basis. B. The received date of claim/amended return Refund Statute Control Date is more than 3 years after RDD or 2 years after the payment of tax, whichever is later.

IRC 6407, and Rev. Rul. 2001–40, 2001–2 C.B. 276 provides that the certifying officer authorizes a credit or refund by signing a schedule of overassessments identifying the taxpayer and the amount of the overassessment. Most recently, in Judicial Watch, Inc. v. Department of Justice, the D.C. Circuit applied the presidential communications privilege — a privilege it had first recognized just seven years earlier — under Exemption 5 of the FOIA to protect Department of Justice records regarding the President’s exercise of his constitutional power to grant pardons.

“Priority dates from the time a filing is first made covering the collateral or the time the security interest is first perfected, whichever, is earlier….” Here, HSBC obtained a perfected security interest in the goods as of the date of filing, December 5, 1987. As indicated above, Finkenrath had no automatically perfected security interest under Article 2. Therefore, it obtained a perfected security interest upon filing on April 28, 1988.

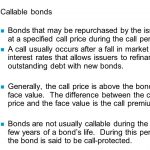

What is an exception in banking?

Key Takeaways

An exception item, in banking, refers to a transaction that is unable to be fully processed. Hold-ups can include simple mistakes like a typo or missing signature, to more structural problems like a stop payment or bounced check.